PBM Reform

Everything You Need to Know About PBMs: The Hidden Middlemen Controlling Your Prescription Access

Quick Guide: PBMs at a Glance

Overview: Pharmacy Benefit Managers (PBMs) are the middlemen who manage every aspect of the prescription drug benefits process for health insurance companies, self-insured employers, unions, and government programs.

The Problem: PBMS operate as the gatekeepers to patient care, using secretive rebate schemes and administrative barriers to control patient access to medications while inflating healthcare costs.

Patient Impact: As a result of pharmacy benefit managers, patients are likely to face:

- Reduced Access to Care: PBMs limit patient access to treatments by restricting medications on drug formularies, requiring patients to fail first with step therapy and using drug exclusion lists that block access to certain drugs.

- Higher Out-of-Pocket Costs: PBMs actually increase patients’ out-of-pocket costs by pocketing drug rebates that were intended for patients. PBMs use “spread pricing” to charge patients more money than the amount reimbursed to the pharmacy.

- Treatment Delays: PBMs can cause treatment delays with prior authorization requirements that force patients to complete additional paperwork and receive special approval before receiving their medications.

- Barriers to Care: PBMs interfere with the doctor-patient relationship by imposing obstacles for patients to overcome before they provide access to some treatments.

- Price Mystery: PBMs operate without transparency and oversight, keeping their lucrative rebate contracts secret. PBMs use “clawback” payments to rescind payments made to pharmacies retroactively and arbitrarily.

- Reduced Pharmacy Choice: PBMs use their market dominance to close down small neighborhood pharmacies by steering patients to the largest national chains.

Our Solution: We support greater transparency and accountability for pharmacy benefit managers, including clear reporting on PBM profits, rebates, and administrative fees. We need a federal ban on predatory practices, such as spread pricing and arbitrary clawbacks. We also support delinking PBM compensation from list prices, which perversely incentivize higher drug prices.

How You Can Help: You can help by contacting your federal representatives and urging support for PBM Reform Act of 2025, which would end abusive practices by pharmacy benefit managers and substantially lower out-of-pocket costs for millions of patients.

What are Pharmacy Benefit Managers?

PBMS Defined

Pharmacy Benefit Managers (PBMs) are the middlemen who manage every aspect of the prescription drug benefits process for health insurance companies, self-insured employers, unions, and government programs. PBMs negotiate prescription drug prices with manufacturers on behalf of health insurance companies and use a rebate system in this process.

Despite their outsized impact on health costs, PBMs operate out of the view of regulators and consumers. According to the New York Times, “Pharmacy benefit managers are driving up drug costs for millions of people, employers and the government.”

PBMs set prescription costs, decide what drugs are covered by insurance plans and in what order those drugs are placed on the formulary, and determine how those drugs are dispensed.

PBMs Negative Impact on Healthcare

Investigative journalists - ranging from the New York Times to the Wall Street Journal have detailed the outsized and powerful role that PBMs have in shaping patient access to healthcare. The New York Times’ Rebecca Robbins and Reed Abelson describe PBMS as a “collection of powerful forces that often escape attention, because they operate in the bowels of the health care system and cloak themselves in such opacity and complexity that many people don’t even realize they exist.”

Meanwhile, the Wall Street Journal’s David Wainer writes that “PBMs operate in a highly complex and opaque world where key information is kept from the public.”

Market Dominance: The Big 3

PBMs began as third-party companies hired by health plans to manage prescription drug benefits. Then, things changed.

Today, PBMs are vertically integrated healthcare conglomerates with unprecedented power over patient care. The "Big Three" PBMs control prescription drug access for more than 200 million Americans.

The Big Three PBMs are:

- CVS Caremark (owned by CVS Health)

- Express Scripts (owned by Cigna)

- OptumRx (owned by UnitedHealth Group)

Industry expert Drug Channels estimates that the three PBM giants processed approximately 80 percent of all prescription drug claims in the United States. Their vertical integration with the largest insurance companies and pharmacy chains means they profit at every step of your prescription journey from determining coverage to dispensing your medication.

How PBMs Manipulate Drug Pricing

PBMs operate in the shadows, using complex schemes that inflate healthcare costs while creating life-threatening barriers to care.

How PBMs Work

To understand how pharmacy benefit managers, you have to understand that medications have two costs: 1) the list or advertised price and 2) the actual reimbursed price.

List prices are easily and publicly available. It’s also the amount used for calculating what patients pay for their co-pay or patient cost-sharing amount.

But, PBMs don’t pay the full list price - they pay less - a lot less. But because rebate contracts and net prices are secret, the full extent of the practice and how much it costs the health system in unrealized savings is unknown. PBMs have operated for decades with little to no oversight and even less transparency. Nothing stops PBMs from pocketing these rebates and not passing the savings on to the patient.

PBMs Increase Health Care Costs

PBMs sell themselves as companies that help reduce drug costs. But, the opposite is true: PBMs are dramatically increasing the cost of healthcare for Americans. A 2024 New York Times investigation found that PBMs “steer patients toward pricier drugs, charge steep markups on what would otherwise be inexpensive medicines and extract billions of dollars in hidden fees.”

Pharmacy Benefit Managers Unfair and Anti-Patient Business Practices

Rebate Schemes

PBMs negotiate significant rebates from drug manufacturers to secure favorable placement of drugs on insurance formularies. These rebates are often calculated as a percentage of a drug's list price, creating a perverse incentive for PBMs to prioritize more expensive drugs to obtain larger rebates. A landmark 2020 study by the University of Southern California's Schaeffer Center found that for every $1 increase in prescription drug rebates, the average list price of a drug rose by $1.17.

Gag Clause

Contracts between the health insurers, PBMs and their network pharmacies often include a “gag clause” which prevents pharmacists from telling the patient about additional purchase options, including that their medication could cost less if they pay the out-of-pocket price instead of going through their insurance. This practice can lead to patients overpaying for prescriptions because the cash price might be lower than their insurance copay, a situation that benefits PBMs through a "clawback" of the difference.

According to Michael Gabay, University of Illinois at Chicago College of Pharmacy, “a 2016 survey involving over 600 pharmacies, approximately 39% of respondents stated that a gag clause prevented them from informing patients about other payment options between 10 and 50 times in the last month.”

Formulary Manipulation and Exclusion Lists

PBMs create drug formularies that can block access to the medicine your doctor prescribed, often favoring drugs that generate higher rebates rather than those that are most effective or affordable for patients.

Even worse, they create "exclusion lists" to drop coverage for breakthrough medications, including life-saving cancer and diabetes treatments. In 2016, CVS announced it would exclude more than 30 new medications, including groundbreaking cancer and diabetes drugs, despite reporting a robust $2.4 billion quarterly profit the same day.

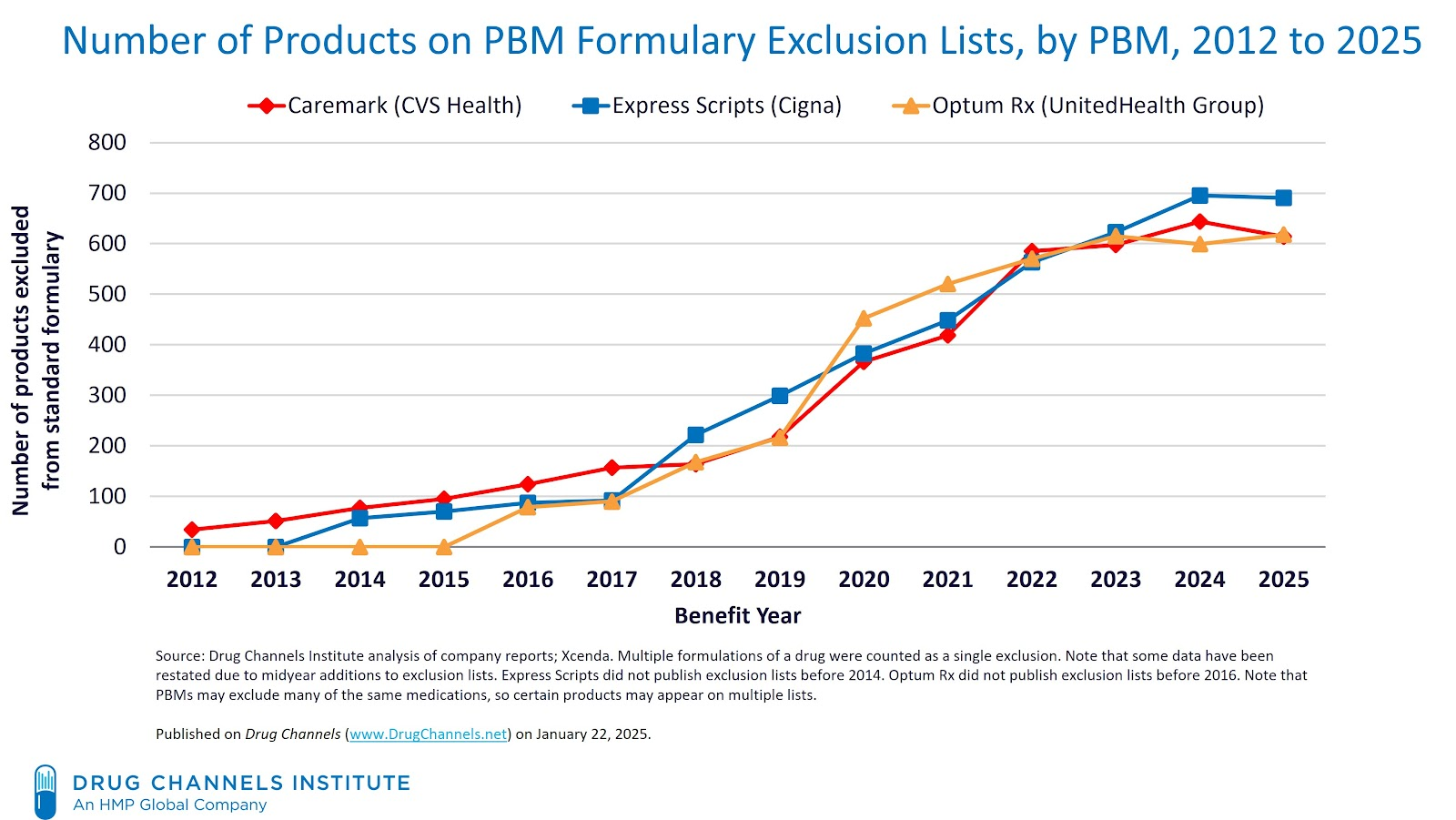

Exclusion lists have skyrocketed in recent years. As of 2025, according to industry expert Drug Channels, exclusion lists now exceed more than 600 products for each of the three major PBM formularies.

Spread Pricing

Spread pricing occurs when a PBM charges a payer (e.g., health plan, patient, government program) more for a drug than it reimburses the pharmacy, pocketing the "spread" or difference.

State audits have found PBMs engaging in significant spread pricing schemes, costing state Medicaid programs hundreds of millions of dollars. When the Ohio Department of Medicaid conducted its review of PBM abuses in Ohio, it found “PBMs pocketed a whopping $223.7 million in spread pricing alone in the Medicaid managed care program.” According to the Ohio Pharmacists Association, “While this total is large in its own right, perhaps most revealing is that this amount did not include other PBM revenue streams like transaction fees and drug rebates.”

An audit by New York's Comptroller found that Medicaid overpaid managed care organizations (MCOs) and their pharmacy benefit managers (PBMs) by $605 million over four years due to MCOs and PBMs prioritizing their own financial benefit when creating drug formularies and managing the benefit.

Drug Tiering

Pharmacy benefit managers wield enormous power over patient medication costs by strategically placing drugs on different insurance formulary tiers. Patients face increasingly complex and expensive cost-sharing structures. A 2023 study published by the National Institutes of Health (NIH) found that in the federally facilitated marketplace for Illinois, the median number of formulary tiers increased from 5 to 7 between 2014 and 2018

These tier decisions aren't based on clinical effectiveness or a drug's actual cost. Instead, it’s driven by the secretive rebate negotiations. PBMs often place drugs on lower tiers in exchange for higher manufacturer rebates, prioritizing their own profits over patient affordability.

Illegal "Adverse Tiering" Persists

The federal government has identified "adverse tiering"—placing all drugs for a specific condition on the highest cost tier—as discriminatory and a violation of Affordable Care Act protections. Despite federal guidance directing PBMs to consider clinical value alongside cost, these discriminatory practices continue, creating financial barriers that can force patients to delay or abandon essential treatments.

A 2022 patient coalition of 105 organizations, on behalf of millions of patients and Americans who live with complex conditions such as HIV, autoimmune diseases, cancer, diabetes, kidney disease, lupus, hemophilia, mental illness, and hepatitis warned, “Some PBMs place all or a majority of drugs to treat a certain condition or disease on the highest drug tier, such as a specialty tier. The federal government has called this practice “adverse tiering.”

Clawbacks and Retroactive Robbery

PBMs use "Direct and Indirect Remuneration" (DIR) fees to retroactively claw back money from pharmacies weeks or months after prescriptions are filled. These arbitrary fees, often based on opaque performance ratings, can result in pharmacies losing money on the medications they dispense to patients. The shocking growth: DIR fees increased by 107,400% from 2010 to 2020, devastating independent pharmacies and limiting patient access to local care.

How PBMs Harm Patients

Case Study: Higher Insulin Prices Caused by PBMs

PBMs pocket the rebates meant for patients. Take insulin. From 2014 to 2018, the net price received by insulin manufacturers decreased by 31%, but at the same time, the share earned by PBMs increased by 155%, according to an independent study published in JAMA Health Forum.

Destroying Small Neighborhood Pharmacies

PBM practices are eliminating independent pharmacies and reducing healthcare access in rural America.

The New York Times in October 2024 shared the story of Jon Jacobs, a 70-year-old pharmacist, who was forced to permanently close Yough Valley Pharmacy in Confluence, Pennsylvania. Jon spent half his life serving as the neighborhood drugstore for his rural town of roughly 1,000 residents. The Times reported that "obscure but powerful health care middlemen" known as pharmacy benefit managers (PBMs) had "destroyed his business."

PBM Barriers to Access

Perhaps most disturbing is how PBMs interfere directly with medical decisions:

Step Therapy ("Fail First")

This cruel practice forces patients to try and fail on older, cheaper, often less effective drugs before accessing the treatment their doctor originally prescribed. Patients must literally get sicker before they can access better care.

Prior Authorization Delays

These bureaucratic hurdles create dangerous delays in treatment while patients' health hangs in the balance, transferring medical decision-making power from doctors to insurance bureaucrats.

Patient Steering:

PBMs manipulate patients away from independent pharmacies toward their own retail and mail-order operations, often eliminating access to trusted local pharmacies.

Fact vs. Fiction: PBM Propaganda vs. Patient Reality: A Fact Check

PBMs spend millions on marketing campaigns claiming they help patients. Here's what they say versus what patients experience:

CLAIM: "PBMs lower prescription drug costs for patients."

REALITY: The PBM rebate system incentivizes high list prices. Patients pay co-insurance based on inflated list prices while PBMs pocket the rebates. The savings rarely reach patients at the pharmacy counter. A 2020 USC study found that for every $1 increase in rebates, the list price rose by $1.17, illustrating the relationship between rebates and list price.

CLAIM: "PBMs help patients stay on their medications"

REALITY: PBM practices like prior authorization, step therapy, and non-medical switching disrupt patient care and force medication changes without medical justification. Forcing patients to "fail first" on inferior treatments is the opposite of helping them stay healthy. The negative health impacts are real. One study of rheumatoid arthritis (RA) patients found those forcibly switched to a different medication experienced 41 percent more ER visits.

CLAIM: "PBMs provide access to pharmacy networks"

REALITY: PBMs use their monopoly power to eliminate thousands of independent pharmacies from networks, steering patients to their own profitable operations. This disproportionately harms rural communities and reduces patient choice.

Watch: Unmasking Healthcare Gatekeepers: Benefit Managers & Access to Care

Real Patients Harmed by PBMs

Patients Rising has documented heartbreaking cases of PBM abuses nationwide.

Sarah, a 32-year-old with rheumatoid arthritis, watched her medication costs jump from $50 to $500 per month. Her PBM moved her drug to a higher tier. “I had to choose between paying rent and managing my pain,” she said.

Michelle, a cancer survivor, faced a similar problem. Her PBM made her pay $60 for a prescription that cost only $40 without insurance. “Why should using my insurance make the medication more expensive?” Michelle asked.

John, a diabetic, was forced to switch to a less effective insulin. His PBM removed his preferred brand from the formulary. “I spent months trying to stabilize my blood sugar levels,” he said.

Video: Michele's PBM Story

Framework for PBM Reform: Putting Patients First

Across the country, patients, doctors, and policymakers are fighting back against PBM abuses. Real reform must address these key areas:

Transparency and Accountability

- Require PBMs to disclose all rebates, fees, and profits

- Mandate clear reporting on how "savings" actually benefit patients

- End the black box of PBM pricing schemes

Direct Patient Benefits

- Ensure negotiated discounts pass through directly to patients at the pharmacy counter

- Ban co-pay accumulators that prevent patients from using manufacturer assistance

- Protect patients from arbitrary cost-sharing increases

Eliminating Anti-Patient Practices

- Ban spread pricing and DIR fee clawbacks

- Prohibit patient steering to PBM-owned pharmacies

- End discriminatory practices that favor PBM profits over patient health

Protecting Medical Decisions

- Eliminate disruptive "fail first" step therapy requirements

- Reduce excessive prior authorization delays

- Restore the doctor-patient relationship as the primary healthcare decision-maker

Legislation: PBM Reform Act: Long Overdue Reforms

Patients Rising is working to mobilize patients nationwide to support the comprehensive PBM reform. The PBM Reform Act is a bipartisan bill, authored by Rep. Earl L. “Buddy” Carter (R-GA) and a dozen co-sponsors, targets pharmacy benefit managers, would end abusive practices by pharmacy benefit managers and substantially lower out-of-pocket costs for millions of patients.

The PBM Reform Act includes several long-overdue reforms that Patients Rising has championed for years:

- Bans Spread Pricing in Medicaid: PBMs will no longer be allowed to engage in spread pricing, where patients are charged more than the reimbursement amount.

- Delinking PBM Compensation from Drug Prices: Removes incentives that reward PBMs for choosing high-cost drugs over affordable alternatives under Medicare Part D.

- New Transparency Requirements: Requires semi-annual reporting on rebates, drug spending, and formulary decisions to promote transparency.

- Enhanced Oversight: Bolsters the Centers for Medicare and Medicaid Services authority to define and enforce fair contract standards between PBMs and pharmacies.

The legislation has strong bipartisan backing with 11 co-sponsors: Reps. Debbie Dingell (D-MI), Greg Murphy (R-NC), Deborah Ross (D-NC), Jodey Arrington (R-TX), Diana Harshbarger (R-TN), Vicente Gonzalez (D-TX), Rick Allen (R-GA), Raja Krishnamoorthi (D-IL), John Rose (R-TN), Derek Tran (D-CA), and Nicole Malliotakis (R-NY).